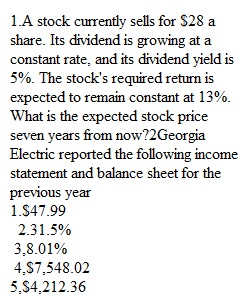

Q 1.A stock currently sells for $28 a share. Its dividend is growing at a constant rate, and its dividend yield is 5%. The stock's required return is expected to remain constant at 13%. What is the expected stock price seven years from now?2Georgia Electric reported the following income statement and balance sheet for the previous year 3.Question 3 5 out of 5 points Three-year Treasury securities currently yield 6%, while 4-year Treasury securities currently yield 6.5%. Assume that the expectations theory holds. What does the market believe the rate will be on 1-year Treasury securities three years from now? 4.Suppose you borrowed $25,000 at a rate of 8% and must repay it in 4 equal installments at the end of each of the next 4 years. How large would your payments be?5.You have a chance to buy an annuity that pays $1,000 at the end of each year for 5 years. You could earn 6% on your money in other investments with equal risk. What is the most you should pay for the annuity?

View Related Questions